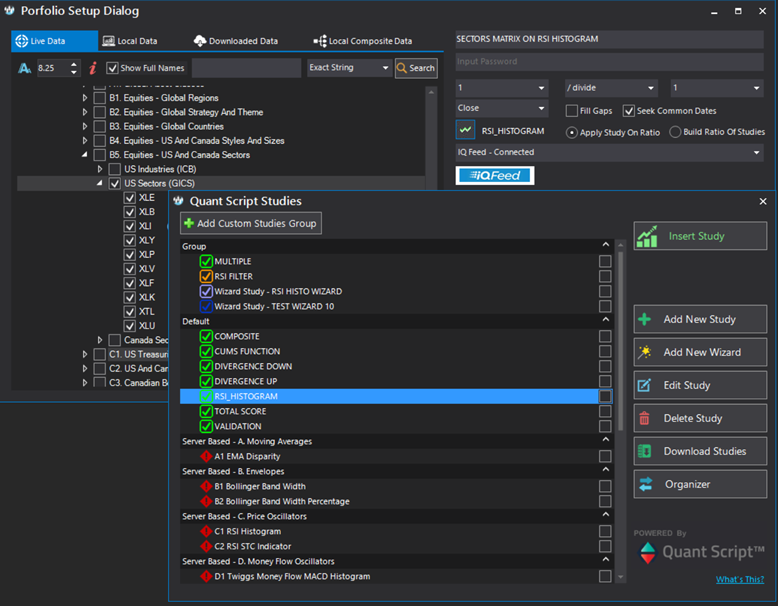

Rule-based portfolio construction.

Analyze patterns of relative strength based on any property you want inside any investment universe you deem appropriate. Build inclusion / exclusion rules for increased objectivity and improved portfolio results.

You can evaluate any universe of investments based on the property / properties measured by any local or server-hosted custom study. The evaluation can be conducted in any time frame and at any point in time.

The matrix calculation is optimized based on both the RESULT and the REVERSE_RESULT functions. It is thus very important that custom studies used inside portfolio systems have both a function and its inverse correctly defined.

Computing the matrices will yield individual relative strength numbers and thus objective peer and universe ranking. Each individual constituent’s rank will be given by how well it does relative to constituents in its group or in the entire investment universe, as measured by the custom study chosen to evaluate the portfolio for.