All popular order types.

Post trades and orders using all popular order types and order flags.

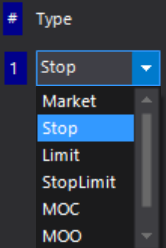

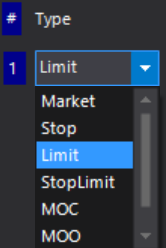

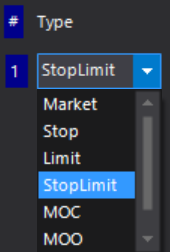

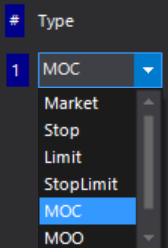

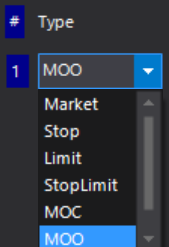

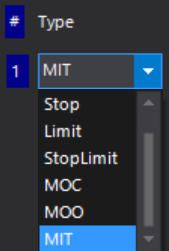

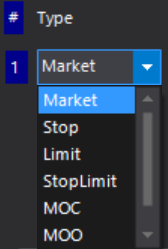

Order types

A market order is the simplest of the order types. A market order is a buy or sell order to be executed immediately at the current market prices.

Market orders are filled to the extent there are willing sellers and buyers. You should use market orders when certainty of execution is a priority over the price of execution.

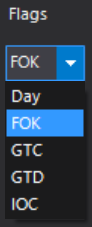

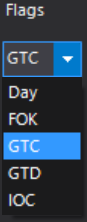

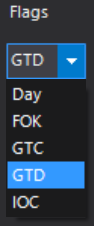

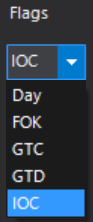

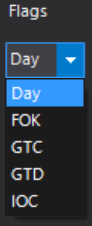

Order flags

A day order is one of several different order duration types that determine how long the order is in the market before it is canceled. A day order is an order to buy or sell a security that automatically expires if not executed on the day the order was placed.

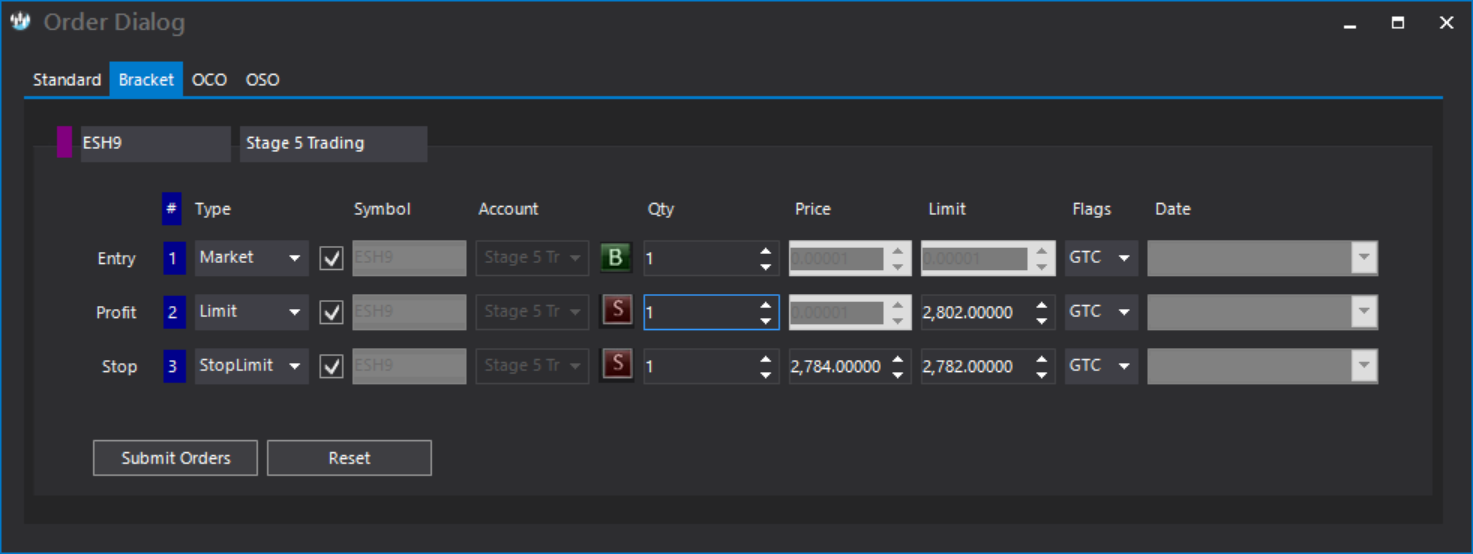

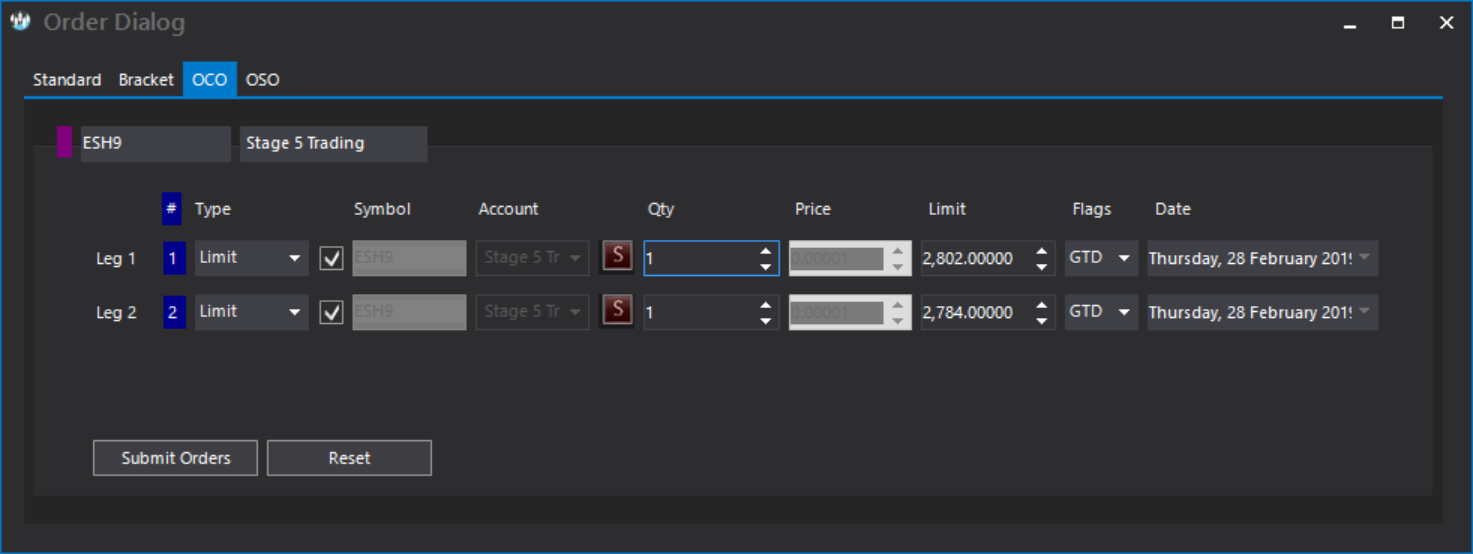

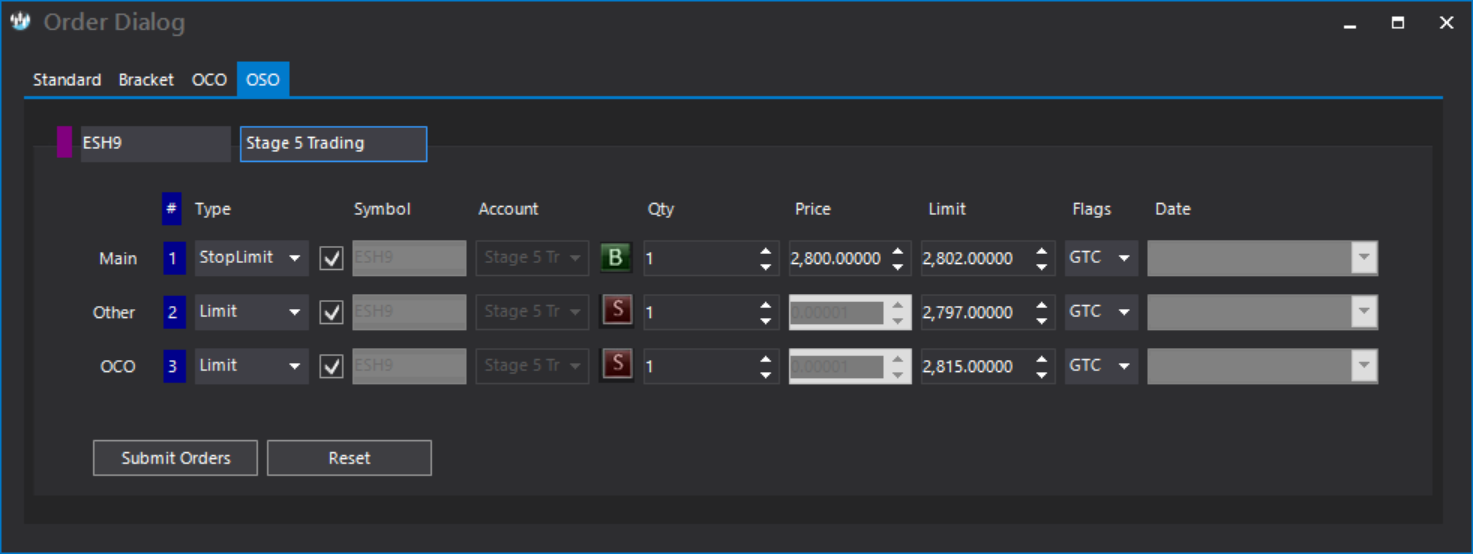

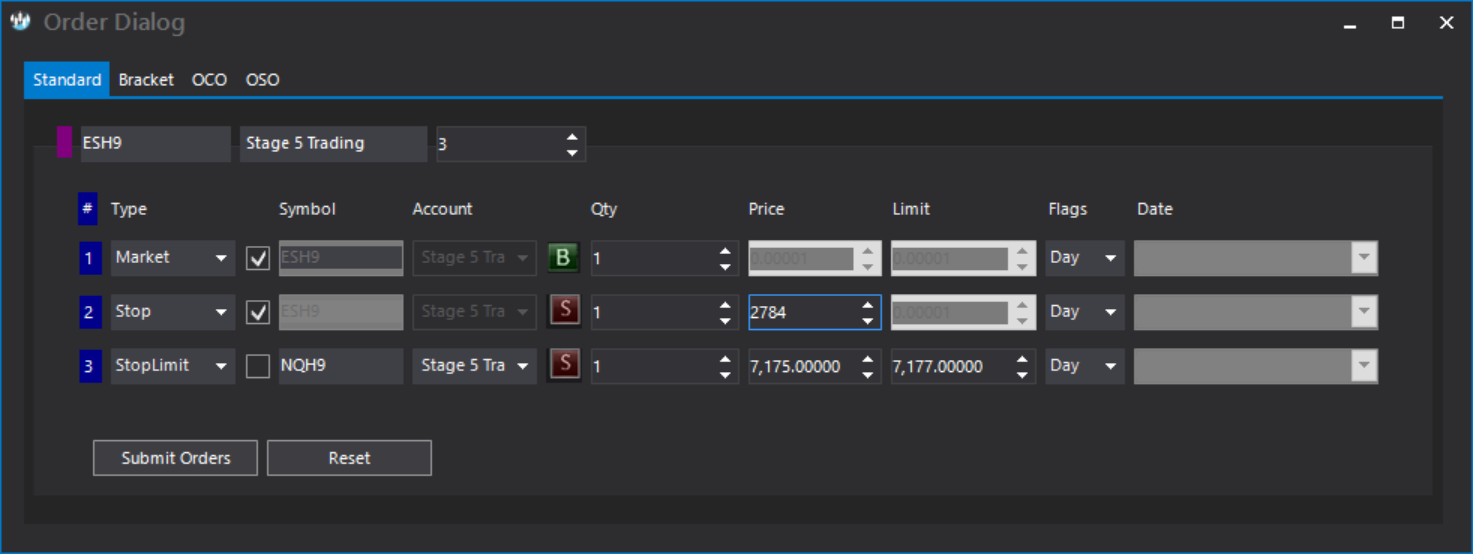

Order batches

Place as many orders as you wish in one click. Place any order type, with any flag on the same instrument / symbol or on different ones.