Matrix-driven portfolio selection.

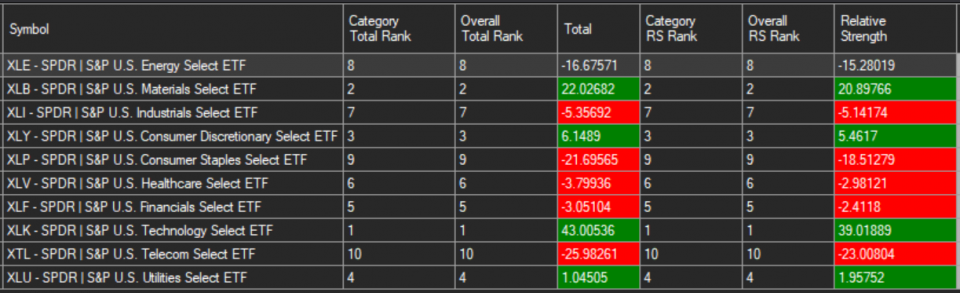

Assess relative strength patterns based on any property, formula, criteria or algorithm. Determine cumulative relative strength curves within any given investment universe. Create objective inclusion / exclusion criteria for portfolio constituents based on statistical analysis of individual relative strength numbers.

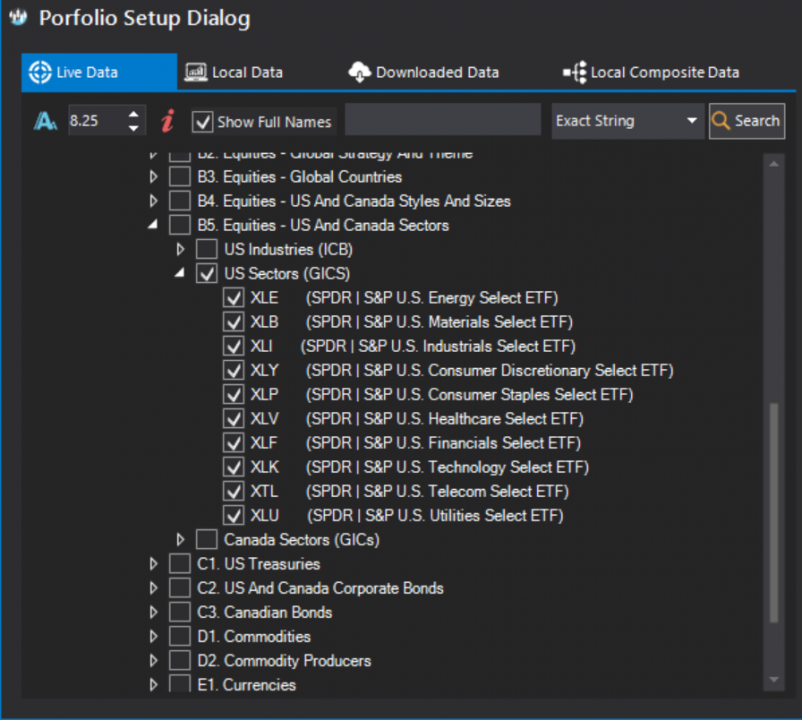

Analyze any portfolio or universe of investments. Easily include markets and instruments by simply clicking them in the Instrument Panel. You can use all the available live, local and downloaded data.

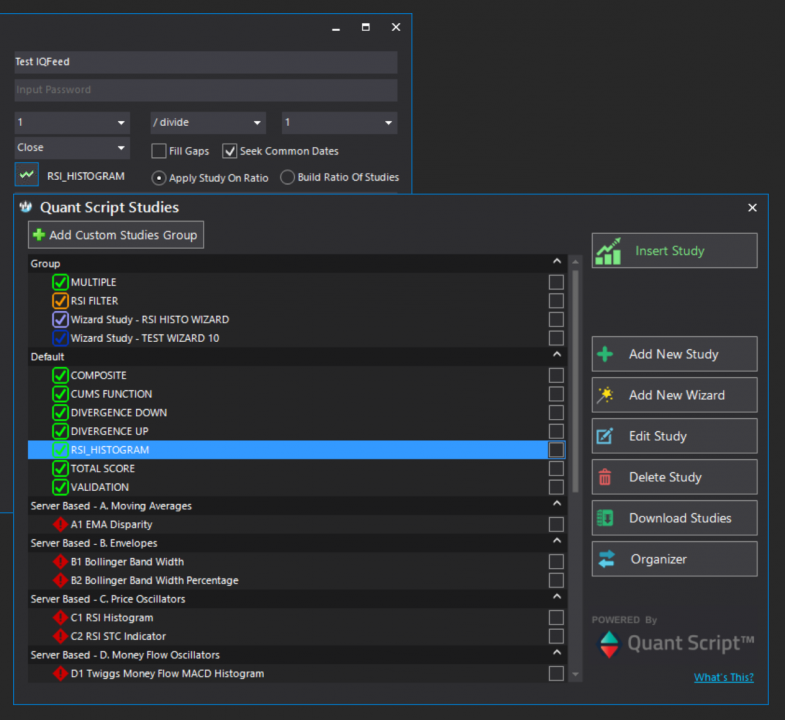

Build data composites (i.e. relative strength lines) involving any basic mathematical operation on one or multiple data fields (open, high, low, close). Compute the matrix based on any previously defined property / custom study. Build matrix results by applying such custom studies to ratios between two different instruments; or by building ratios of custom studies applied to two different instruments.

Get total relative strength points as well as peer and group rankings for all portfolio constituents. Model relative strength curves and rankings using any built-in function or any custom study to objectively determine portfolio weights.