Equity valuation studies.

Valuation studies derived directly from company balance sheet data to understand and model intrinsic values. Compare benchmark and actual valuation multiples to understand how fundamental value is created or eroded.

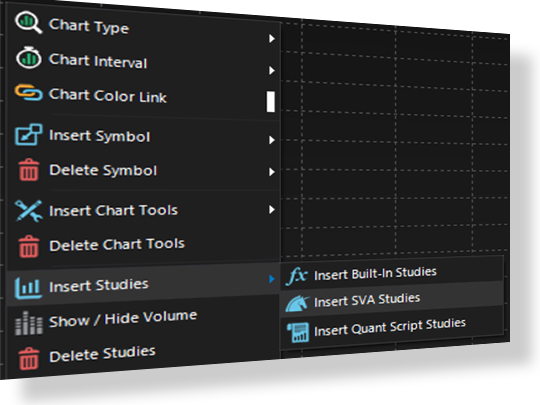

The SVA equity valuation studies are extremely relevant to equity traders and investors. Thanks to our partnership with our friends at Strategic Analysis Corporation (1994), the S-Trader platform gives you the ability to plot popular technical studies and fundamental studies based on balance sheet analysis all in the same frame / window. In addition, the Quant ScriptTM engine allows you to write scripts using the built-in technical and statistical functions, the SVA equity valuation functions or a combination of both. The SVA equity valuation functions can in fact be nested at any iteration inside any other technical and statistical function for some truly powerful and objective analysis and scripting on the firm’s intrinsic value and stability, as they result directly from the firm’s balance sheet.